Apply For Short Term Private Mortgage Online

Warning: Undefined variable $PostID in /home2/comelews/wr1te.com/wp-content/themes/adWhiteBullet/single.php on line 66

Warning: Undefined variable $PostID in /home2/comelews/wr1te.com/wp-content/themes/adWhiteBullet/single.php on line 67

|

| Articles Category RSS Feed - Subscribe to the feed here |

|

|

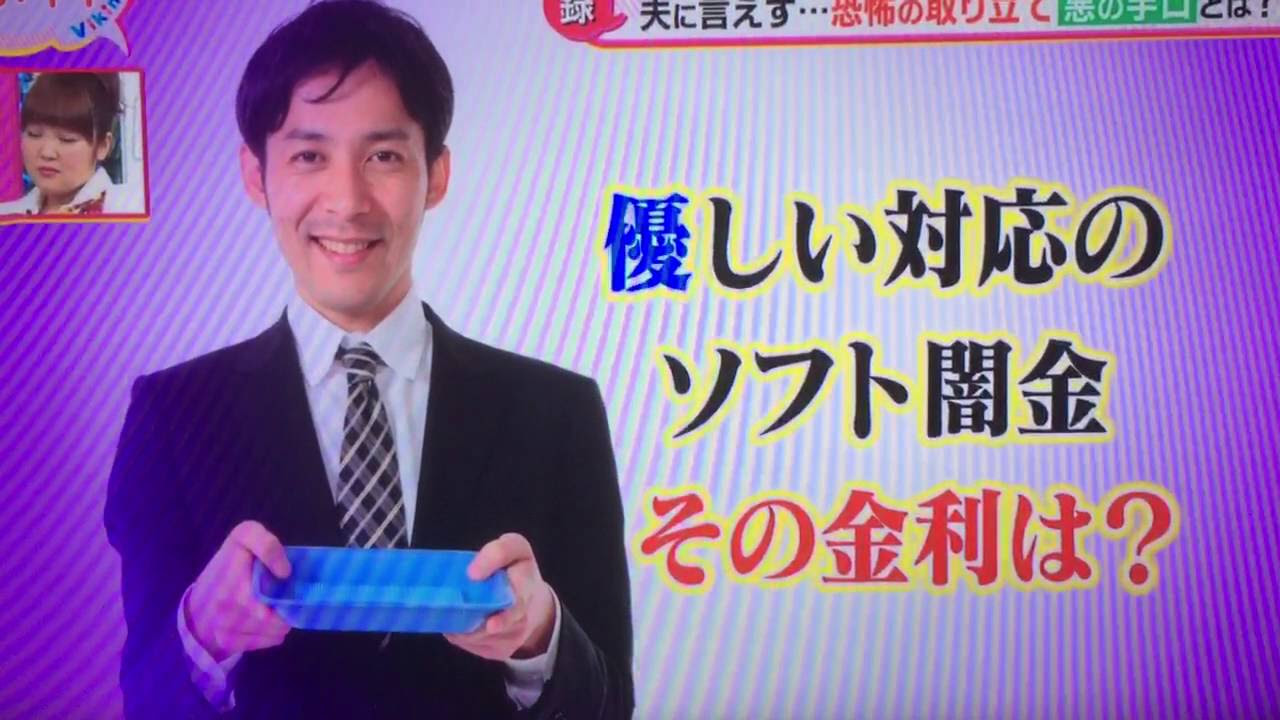

Hero FinCorp personal loan app is a complete digitized instant mortgage platform. You possibly can handle your mortgage account on-line and test essential details like interest fee, EMIs, and repayment tenure from anyplace at the tip of your finger. So, take a threat-free short-time period loan via Hero FinCorp and pay at your comfort in a versatile tenure of 6 months to 2 years.

Inside hours of the bond market ructions, the bank scrambled to restrict the harm by means of direct intervention in the bond market. It instantly reversed its coverage of quantitative tightening-that is, the promoting of bonds as a part of a policy to mop up liquidity and struggle inflation-and embarked upon a dedication to buy up to five billion pounds (roughly $5.6 billion) of lengthy-dated bonds every day for the next thirteen weekdays. In impact, the bank was now the guarantor of gilt costs. As envisaged, this measure assuaged fears and arrested the rise in bond yields, a minimum of briefly, with actual purchases of the bank well below the ceiling set. A few days later, the government did an about-face on the most controversial element of the chancellor’s assertion, ソフト闇金まるきんはこちら the minimize in tax rates on excessive-revenue earners. This alteration is politically necessary but quantitatively trivial. Nonetheless, a measure of calm has been restored. It may effectively provide pension funds with the time wanted to unwind dangerous leverage.

– Insufficient Data: Whereas overall mortgage accounts have been rising the actual impression of these loans on the poverty-stage of clients is sketchy as knowledge on the relative poverty-level enchancment of MFI clients is fragmented.

– Affect of COVID-19: It has impacted the MFI sector, with collections having taken an preliminary hit and disbursals yet to observe any meaningful thrust.

– Social Goal Overlooked: In their quest for progress and profitability, the social goal of MFIs-to bring in enchancment in the lives of the marginalized sections of the society-seems to have been step by step eroding.

– Loans for Conspicuous Consumption: The proportion of loans utilized for non-income producing purposes may very well be a lot larger than what’s stipulated by RBI. These loans are quick-tenured and given the economic profile of the shoppers, it is likely that they soon discover themselves in the vicious debt trap of getting to take one other mortgage to pay off the primary.

– Business financing permits you to borrow cash without promoting a proportion of your company’s possession to traders in change for funds. Because of this, you should use the money however you need and run your online business based on your plans. There won’t be any other entrepreneurs interfering with your choices. You won’t need to work alongside any other individuals or take into consideration the opinions of others.

– Your lender shouldn’t be going to let you know how one can spend the money. They could ask for your marketing strategy to grasp the way you intend to run what you are promoting, however they won’t have any part in the choice-making after granting you the funds. So long as you’re going to repay the money with interest, nobody cares what you do with the money you borrow.

3. You can easily access the funds

So, in the event you determine to borrow $500, you might want to pay $15 5 times. On your fee due date, you might want to repay $500 (the mortgage’s principal) and $75 of the mortgage curiosity. The APR of this loan will rely on its term. As an example, if it have been 14 days, the APR could be 391.07%.

Find more articles written by

/home2/comelews/wr1te.com/wp-content/themes/adWhiteBullet/single.php on line 180