6 Greatest Brief Term Loans: Fast Money Mortgage Lenders Reviewed

Warning: Undefined variable $PostID in /home2/comelews/wr1te.com/wp-content/themes/adWhiteBullet/single.php on line 66

Warning: Undefined variable $PostID in /home2/comelews/wr1te.com/wp-content/themes/adWhiteBullet/single.php on line 67

|

| Articles Category RSS Feed - Subscribe to the feed here |

|

|

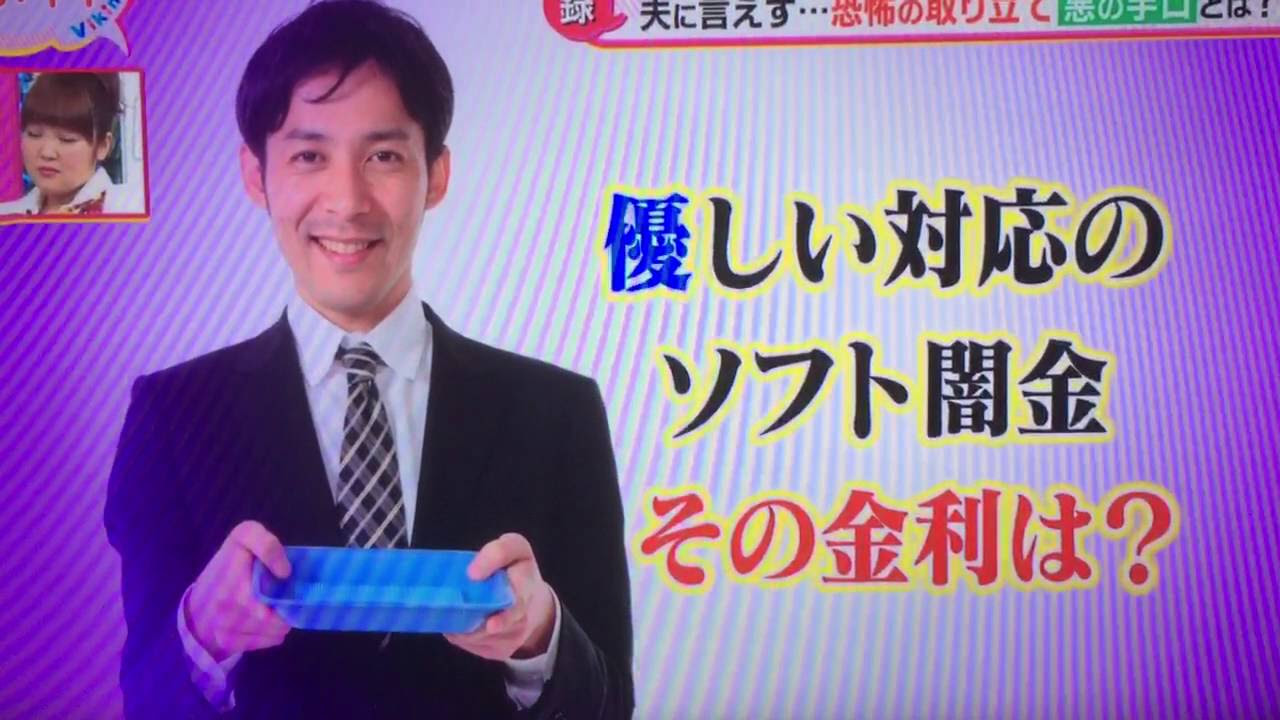

You could also be looking for a brief-term mortgage if you are wanting to build your credit score. Used responsibly for debt consolidation or credit building, brief-time period loans might help put you in a better financial scenario where you possibly can then borrow with decrease interest rates, greater borrowing limits, 信頼できるソフト闇金ならソフト闇金プレステージ and other perks.

Initially, the OCLF was established to fill an area want by providing loans up to $15,000 to individuals with a solid business plan and experience who were not eligible for conventional financing. A special concentrate on youth was made potential through a partnership with the Canadian Youth Business Basis (CYBF). This partnership with the CYBF has resulted in a direct investment of $355,000 in 26 new youth businesses established up to now. The OCLF’s training loan program began when a coalition of native immigrant businesses identified a financing dilemma. Certified internationally-skilled professionals were unable to take part in a program to acquire Canadian accreditation and employment in their fields of experience because they weren’t eligible for student loans or for loans from mainstream financial institutions. The OCLF stepped forward with a specifically-designed loan for newcomers accepted into accreditation packages, bridging the finance hole and allowing these newcomers to realize accreditation in Canada and start working in their fields. Since that time, this system has been expanded to include all Ottawa space residents entering brief-time period job-particular coaching.

A credit card is a revolving credit score account. You possibly can charge as much as a most amount of money (your credit limit) and might carry a stability (“revolve”) from month to month; you’re charged interest on that steadiness. The minimum cost you need to make each month varies relying on how much credit you’ve got used. You decide how a lot you want to repay every month beyond the required minimal.

Ans: You might apply for a mortgage on bank card online via your bank’s cell application, you may apply online by logging into your bank’s internet banking, you might apply by simply making a cellphone name to the bank’s buyer care number, or you could WhatsApp or electronic mail to your accounts relationship manager.

Having a poor credit rating is not an automated barrier to making use of for a payday mortgage on-line. Whereas we cannot claim no credit score test, the lenders in our network take in to account all of the information you submit and won’t make their determination based solely on your credit score history.

Find more articles written by

/home2/comelews/wr1te.com/wp-content/themes/adWhiteBullet/single.php on line 180